Dollar Cost Averaging: A Simple Way to Invest Smart

What Is Dollar Cost Averaging?

Dollar Cost Averaging (DCA) is an easy investment method where you invest a fixed amount of money at regular intervals—like every week or month—no matter what the price of the investment is. It’s a way to slowly build your portfolio without worrying about trying to “time the market.”

How Does It Work?

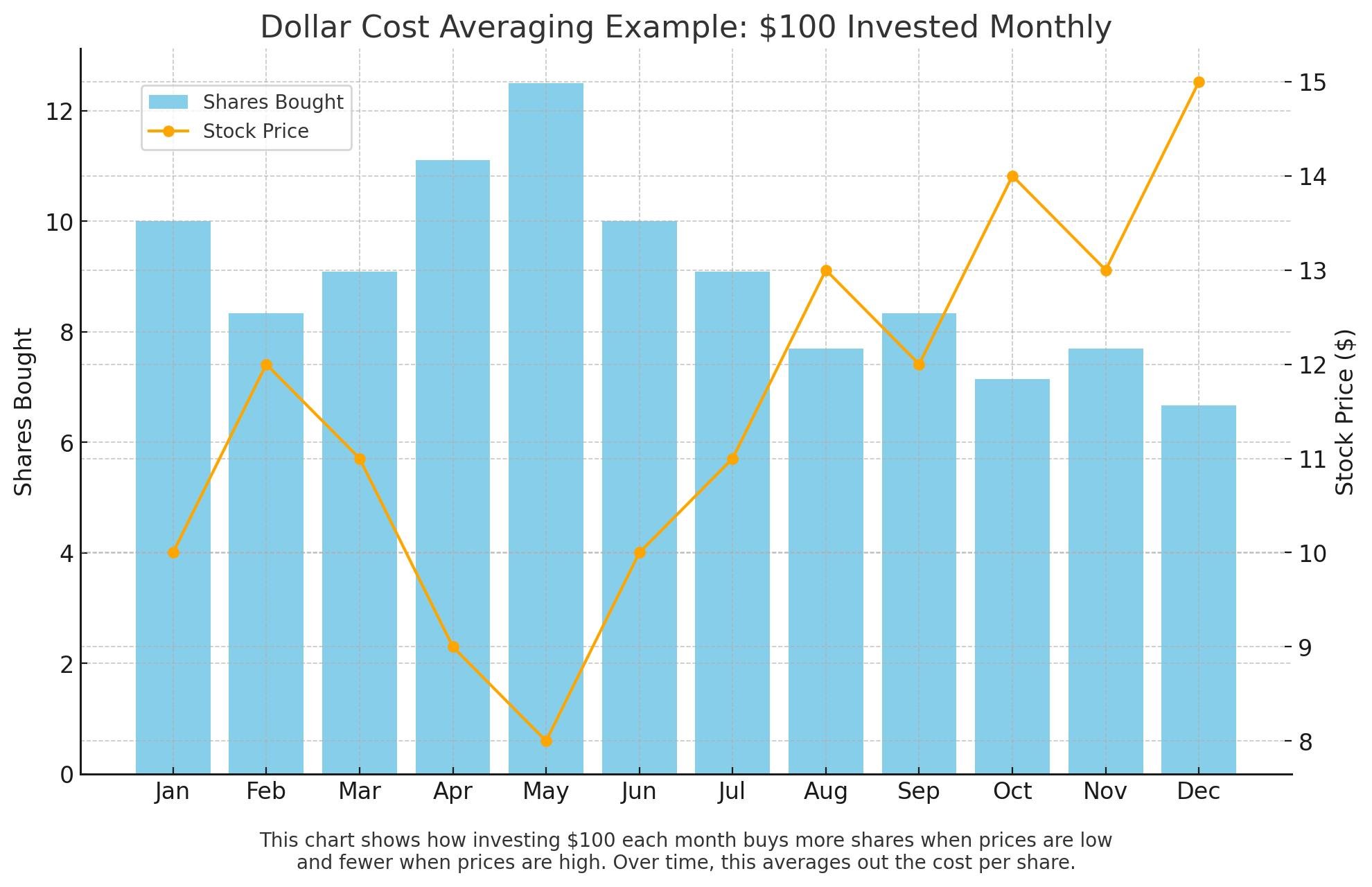

Let’s say you invest $100 every month into a stock. If the price is high one month, your $100 buys fewer shares. If the price is low the next month, your $100 buys more. Over time, this balances out your purchase price and reduces the risk of investing all your money at the wrong time.

Why It’s Good for Beginners

DCA helps remove emotion from investing. You don’t have to guess when the market is up or down—you just stick to your schedule. This makes investing less stressful and helps build good financial habits.

The Long-Term Benefit

DCA works best when you invest consistently over time. Even small amounts can grow into large savings, thanks to the power of compounding. It’s a smart and simple way for beginners to start investing with confidence.

This image illustrates dollar cost averaging by showing how a fixed $100 monthly investment buys varying amounts of shares depending on stock price. When prices drop, more shares are bought; when prices rise, fewer are bought—resulting in a lower average cost over time.